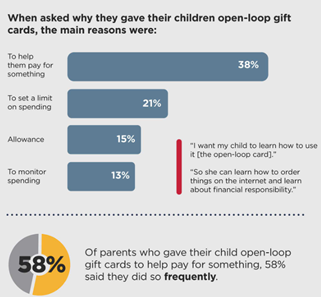

Is this the year your teenager will be venturing off on Spring Break without you? Or maybe they decided to go on a friend only trip? It can be hard to decide how to give them money when you aren’t there. Cash can be risky as it is easily lost or stolen. Giving them your credit card is probably a no-go. According to a study by Incomm, 58% of parents have given their child a prepaid gift card to help them pay for something. Prepaid cards are a very flexible and safe form of payment because they (1) can be used almost anywhere, (2) they allow you to set a limit on spending. and (3) you can monitor the spending.

There are a lot of good prepaid products designed for parents and kids but just be aware of the ‘fine print’. Many cards have fees, offer reload options if they run out of money and allow parents access to check the balance and even transactions. Check out our blog Insider View on Visa Cards to understand more about common fees. For reload options, you can go to the card’s website and transfer money from a bank account. Some products, like MyVanilla, allows you to add money at the register of hundreds of their participating retail locations and even offer a card to card transfers. Knowing how technology-dependent kids are, they can check their balance via an app and get text alerts to stay updated on their balance. However, our favorite feature on products such as MyVanilla is being able to see your teenager’s purchases. It’s important to understand if they are stocking up on souvenirs instead of food! Another favorite feature is they can use some of these prepaid cards at ATMs if they need cash. There are fees associated with most prepaid cards, but they far outweigh some of the other money alternatives for teenagers.